|

|

| << Back Poser >> |

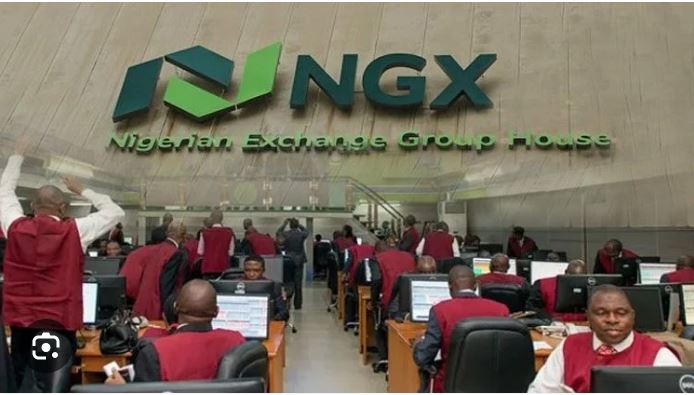

| NGX confirms listing of 3.16billion UBA shares |

The Nigerian Exchange Limited (NGX) has admitted an additional 3.16 billion ordinary shares of United Bank for Africa (UBA) Plc, to its Daily Official List, signalling a major enhancement of the bank’s market capitalisation whilst also deepening liquidity on the capital market.

The NGX noted this in a confirmatory letter to the bank, dated January 12, 2026, and signed by Head, Issuer Regulation Department at NGX, Godstime Iwenkehai, who explained that the additional shares were listed following the successful conclusion of UBA’s recent rights issuance exercise. “Following the submission of all post-approval documents, please be informed that United Bank for Africa Plc’s Rights Issue of 3,156,869,665 ordinary shares of 50 Kobo each at N50.00 per share on the basis of one new ordinary share for every 13 ordinary shares held were formally listed on the Daily Official List of Nigerian Exchange Limited (NGX) on , Monday, 12 January 2026”, Iwenkehai stated in the letter. UBA’s Group Managing Director/CEO, Oliver Alawuba, who received the letter, commended the confirmation, as he noted that the move underscores robust investor confidence in the bank’s capitalisation strategy and future prospects. He stated: “We welcome the formal confirmation from NGX on the listing of our rights issue shares. This successful transaction reflects strong investor confidence in UBA’s financial strength, governance, and growth strategy. Needless to say that the additional capital will further support our Pan-African and global expansion, and enhance our capacity to deliver sustainable value to all stakeholders.” In November 2024, the bank had raised N239 billion, which elevated its capital base to N355 billion at that time, while the recently concluded rights issue has injected an additional N158 billion, bringing the bank’s total capital to N513 billion. This latest influx means UBA’s qualifying capital base now surpasses the N500 billion requirement by the Central Bank of Nigeria (CBN), thereby exceeding the recapitalisation minimum for banks with international authorisation. |

| Vanguard Business News |

|

Dangote Cement revenue hits N4.31trn as profit tops N1trn Dangote Cement Plc has reported a 20.3 per cent revenue growth to N4.31 trillion for the year ended Dec. 31, 2025. |

|

NGX Group records N15.6bn profit, declares N3.00 dividend …Issues 1 for 3 bonus By Peter Egwuatu The Nigerian Exchange Group, NGX Group has the recorded N15.6 billion Profit Before Tax, PBT, in its audited results for the year ended 31 December 2025, up from N13.6 billion in the corresponding period 2024. The Exchange also declared N3.00 per share dividend and a bonus of one […] |

|

Dangote Refinery charts industrial future with surfactant plant By Providence Ayanfeoluwa Dangote Petroleum Refinery has announced plans to expand beyond crude processing into a fully integrated industrial hub, unveiling five major projects that aim to transform Africa’s manufacturing landscape. The project encompasses the ambitious expansion plan of a 400,000-tonne Linear Alkaline Benzene (LAB) plant to support detergent manufacturing across the continent. Addressing journalists during […] |

|

Oil Theft: How criminal networks are moving from creeks to communities For decades, Nigeria’s oil theft crisis was largely associated with remote creeks, mangrove swamps and offshore vandalism in the Niger Delta. Increasingly, however, security agencies say the trade is migrating inland-embedding itself within civilian communities, markets and transport corridors where it can operate under the cover of everyday commerce. The recent exposure of Owaza Mami Market […] |

|

FG extends ban on Shea nut export to boost domestic processing By Peter Egwuatu, with agency report The Federal Government has extended its ban on Shea nut exports by a year, reinforcing a drive to curb raw commodity shipments and boost local value addition. The extension takes effect from February 26, 2026, to February 25, 2027. Approving the ban, President Bola Tinubu said that Nigeria is trying to […] |

|

Lafarge Africa revenue surges 53% to N1.1trn By Peter Egwuatu Lafarge Africa Plc has announced a revenue milestone of N1.1 trillion in 2025, representing a 53% surge from N696.8 billion recorded in the corresponding period of 2024. Profit After Tax (PAT) rose from N100.1 billion in 2024 to N273 billion representing a 173% increase. The company said this performance is underpinned by volume-led […] |